Debt financing

Vend's sources of debt financing are bonds/FRNs, as well as a flexible revolving credit facility.

In November, Vend purchased its own bonds (VEND02 and VEND03) for the amount of NOK 606 million (VEND02) and NOK 75 million (VEND03).

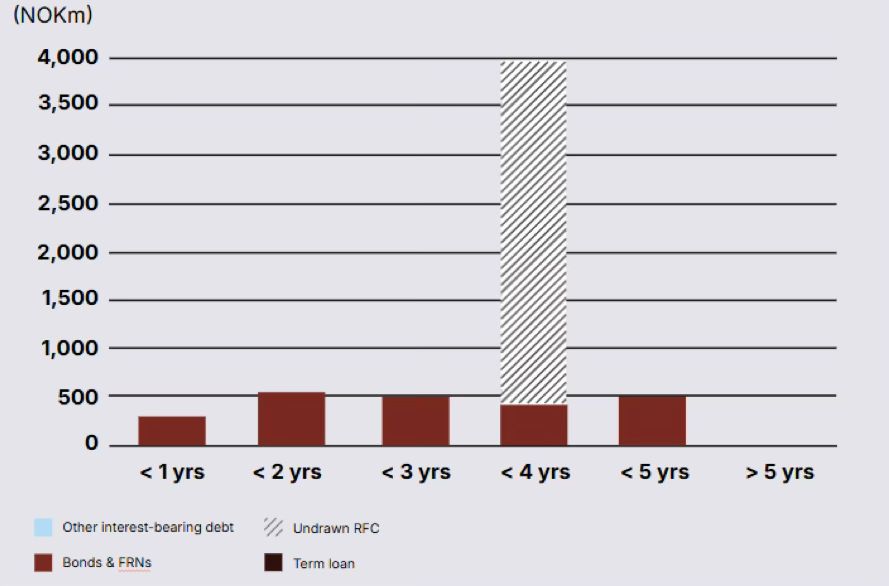

Vend has a revolving credit facility of EUR 300 million. The facility is not drawn and secures a strong liquidity buffer going forward.

In June, Scope Ratings upgraded the issuer rating of Vend Marketplaces ASA to BBB+ with Stable Outlook, confirming Vend as a solid Investment Grade company.

As of 31 December 2025, Vend’s interest-bearing debt is NOK 2 244 million.

Further information on the respective debt categories is found below:

Bonds/Floating Rate Notes (FRN)

ISIN | Amount (million) | Issue date | Maturity | Interest | Security note | Reg. document |

|---|---|---|---|---|---|---|

NO0011157323 | NOK 322 | Nov 2021 | Nov 2026 | 3M NIBOR + 78 bps | ||

NO0012484486 | NOK 525 | Mar 2022 | Sept 2027 | 3M NIBOR + 120 bps | ||

NO0012484494 | NOK 400 | Mar 2022 | Mar 2029 | 3.95 % | ||

NO0012911306 | NOK 500 | May 2023 | May 2028 | 3M NIBOR + 145 bps | ||

NO0012911231 | NOK 500 | May 2023 | May 2030 | 4.85 % |

Credit facility

Facility type | Facility amount (million) | Origination date | Maturity | Interest |

|---|---|---|---|---|

Revolving Credit Facility | EUR 300 | July 2021 | July 2028 | Relevant IBOR + margin |

Revolving credit facility and bonds fall due in their entirety at the stated due date. Final due dates are stated in the above table.

Vend's long-term loans carry a floating interest rate and are linked to the money market interest rates plus a margin. The bonds with fixed interest rate have been swapped to floating interest rate at origination.

Vend's loan agreements contain requirements for net interest-bearing debt (NIBD) in relation to the operating profit before depreciation and amortisation (EBITDA).

Based on the most recently published quarterly report at 31 December 2025, Vend has undrawn credit facility amounting to NOK 3.6 billion.

Debt Maturity Profile 31 December 2025

For more information, see Regulatory Releases